Featured Individual

Benjamin Ricketson Tucker (1854-1939) was an individualist anarchism and self-identified non-state socialist. Tucker was the editor and publisher of the individualist anarchist periodical Liberty (1881–1908). Tucker described his form of anarchism as "consistent Manchesterism" and "unterrified Jeffersonianism".

FreedomCircle.com provides resources to help you understand what has been called the "philosophy of liberty."

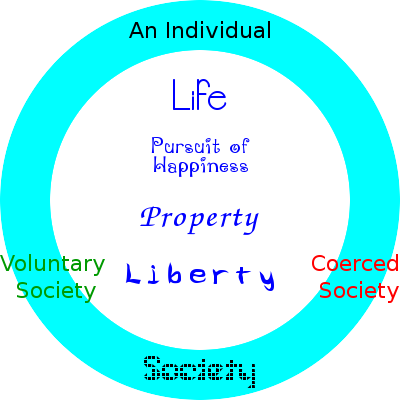

Begin by clicking on one of the items on the Individual-Society graphic below, use the Search box above or follow the navigation links above (or possibly on the left).

The Freedom Circle directory is an extensive reference on topics of freedom and liberty, human life and rational thought, and the economic, legal, political and other aspects conducive to freedom.

In the Main section, the "Show/Hide quotes" button controls the visibility of selected quotes under entries. On a touch-activated device, if quotes are not visible, please tap on an entry to view the corresponding quote. On cursor-controlled devices, the quotes become visible as the cursor moves over the entries.

« Trending »